Macd is one of the simplest and most reliable indicators available. Macd uses moving averages, which are lagging indicators but turn them into a momentum oscillator by subtracting the longer moving average from the shorter moving average. The subtracted value when plotted forms a line that oscillates above and below zero, without any upper or lower limits. Using shorter moving averages(5 & 10) will produce a quicker, more responsive indicator(fast macd), while using longer moving averages(12 & 26) will produce a slower indicator(Slow macd), less prone to whipsaws.

Macd measures the difference between two Exponential Moving Averages (EMAs). A positive Macd indicates that the 5 or 12-day EMA is trading above the 10 or 26-day EMA. A negative Macd indicates that the 5 or 12-day EMA is trading below the 10 or 26-day EMA. If Macd is negative and declining further, then the negative gap between the faster moving average (blue) and the slower moving average (pink) is expanding. Downward momentum is accelerating, indicating a bearish period of trading. Macd centerline crossoversoccur when the faster moving average crosses the slower moving average.

In Jan.2008, Macd turned down ahead of both moving averages, and formed a negative divergence ahead of the price peak(6274).

In Oct.2008, Macd began to strengthen and make higher Lows while both moving averages continued to make lower Lows(2259).

Finally, Macd formed a positive divergence in Mar.2009 while both moving averages recorded new Lows.

MACD Bullish Signals

1.Positive Divergence

2.Bullish Moving Average Crossover

3.Bullish Centerline Crossover

Positive Divergence

A Positive Divergence occurs when Macd begins to advance and the security is still in a downtrend and makes a lower reaction low. Macd can either form as a series of higher Lows or a second Low that is higher than the previous Low. Positive Divergences are probably the least common of the three signals, but are usually the most reliable, and lead to the biggest moves.

Bullish Moving Average Crossover

A Bullish Moving Average Crossover occurs when Macd moves above its 9-day EMA, or trigger line(red). Bullish Moving Average Crossovers are probably the most common signals. If not used in conjunction with other technical analysis tools, these crossovers can lead to some false signals.

Bullish Centerline Crossover

A Bullish Centerline Crossover occurs when MACD moves above the zero line and into positive territory. This is a clear indication that momentum has changed from negative to positive, or from bearish to bullish. After a Positive Divergence and Bullish moving average Crossover, the Bullish Centerline Crossover can act as a confirmation signal.

MACD Bearish Signals

MACD generates bearish signals from three main sources. These signals are mirror reflections of the bullish signals:

1.Negative Divergence

2.Bearish Moving Average Crossover

3.Bearish Centerline Crossover

Negative Divergence

A Negative Divergence forms when the security advances or moves sideways, and the Macd declines. The Negative Divergence in Macd can take the form of either a lower High or a straight decline. Negative Divergences are probably the least common of the three signals, but are usually the most reliable, and can warn of an impending peak.

Nifty showed a Negative Divergence when Macd formed a lower High in Jan.2008(& in Oct.09), and it formed a higher High at the same time. This was a rather blatant Negative Divergence, and signaled that momentum was slowing and Nifty fell strongly.

Bearish Moving Average Crossover

The most common signal, a Bearish Moving Average Crossover occurs when Macd declines below its 9-day EMA. As such, moving average crossovers should be confirmed with other signals to avoid some false readings.

Bearish Centerline Crossover

A Bearish Centerline Crossover occurs when Macd moves below zero and into negative territory. This is a clear indication that momentum has changed from positive to negative, or from bullish to bearish. The centerline crossover can act as an independent signal, or confirm a prior signal such as a moving average crossover or negative divergence. Once Macd crosses into negative territory, momentum, at least for the short term, has turned bearish.

The significance of the centerline crossover will depend on the previous movements of Macd as well. If Macd is positive for many weeks, begins to trend down, and then crosses into negative territory, it would be bearish. However, if Macd has been negative for a few months, breaks above zero, and then back below, it might be a correction. In order to judge the significance of a centerline crossover, traditional technical analysis can be applied to see if there has been a change in trend, higher High or lower Low.

MACD Benefits

One of the primary benefits of Macd is that it incorporates aspects of both momentum and trend in one indicator. As a trend-following indicator, it will not be wrong for very long. The use of moving averages ensures that the indicator will eventually follow the movements of the underlying security. By using Exponential Moving Averages (EMAs), as opposed to Simple Moving Averages (SMAs), some of the lag has been taken out.

As a momentum indicator, Macd has the ability to foreshadow moves in the underlying security. Macd divergences can be key factors in predicting a trend change. A Negative Divergence signals that bullish momentum is waning, and there could be a potential change in trend from bullish to bearish. This can serve as an alert for traders to take some profits in long positions, or for aggressive traders to consider initiating a short position.

Since Macd's introduction, there have been hundreds of new indicators introduced to technical analysis. While many indicators have come and gone, the Macd has stood the test of time. Theconcept behind its use is straightforward, and its construction is simple, yet it remains one of the most reliable indicators around. The effectiveness of the Macd will vary for different securities and markets. The lengths of the moving averages can be adapted for a better fit to a particular security or market. As with all indicators , Macd is not infallible and should be used in conjunction with other technical analysis tools.

MACD Drawbacks

One of the beneficial aspects of the Macd is also one of its drawbacks. Moving averages, be they simple, exponential or weighted, are lagging indicators. Even though Macd represents the difference between two moving averages, there can still be some lag in the indicator itself. This is more likely to be the case with weekly charts than daily charts. One solution to this problem is the use of the Macd-Histogram.

READ more on Macd @ Stockcharts.com

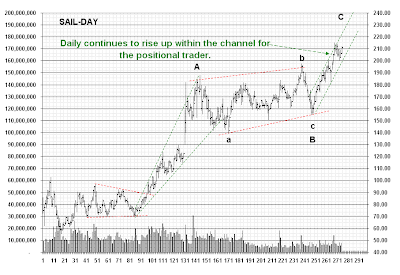

Combining EW with Macd:(Read the related post)

Since the last post on Oct.09, you can see the price declining sharply after a "5 wave structure" and a negative divergence in Macd.

For Investors: Investors who have a huge portfolio can use the weekly macd chart to spot the Negative divergences to "Part Book" once and during the Bearish Cross over a second "Part booking" and a last one at Bearish centreline crossover. Similarly Start buying in parts when Positive divergences start to develop and add more to it with Bullish cross over & Bullish centreline crossover.

For Traders: Use it in combination with other Technical tools such as Stochastics and with a basic EW knowledge to make entry & exits. When you combine your studies of various time frames such as Week, Day & Hour, you have potentially a system which will follow the prices to a good accuracy.

Needless to emphasise here, there are no foolproof systems in stock markets but only more efficient ones in relative term. Yourexperience, your discriminating ability to stay off the market when the picture is muddy & unclear with choppy moves, your patience to wait for good set ups/ opportunities, your intuitive risk taking ability when the euphoria & Fear are at their peaks will set you on a path to riches.